As Malaysia regains its economy through government policy support and the rollout progress of the COVID-19 vaccine, the government is trying to project sustainable and responsible growth through economic financing.

The Securities Commission Malaysia (SC) plans to enhance efficiency in equity crowdfunding by enabling Micro, Small, and Medium Enterprises (MSMEs) and mid-tier companies to fundraise through the capital market.

Significant uncertainties in Malaysia's overall resumption of economic conduct remain, showing gradual recovery for each sector in many paces.

SC seeks to provide policy support and ensure the market remains resilient, focusing on the Malaysian private market as the source to revitalize economic growth this year.

The establishment of the Dana Penjana Nasional program will support VC firms in boosting the local startup ecosystem.

The Dana Penjana Nasional program is a matching fund-of-funds program with the premise that the government will match up to RM 600 million on a 1:1 basis with the VC firms. To date, the program has attracted eight VC fund managers to invest in the country's startups as a part of the RM 1.2 billion goals. The deployment of the funds hopes to spur the domestic startups to innovate and be the country's growth engine.

The total of committed funds at the end of 2020 reached RM 11.7 billion, nearly twice higher than the previous year of RM 5.99 billion. The proportion of funds dominantly sourced from PE firms by RM 7.39 billion.

The commitment to Malaysian PE firms came mainly from corporate investors, taking 31.52 percent of the share. Followed by individuals and family office investors by 17.14 percent and other asset managers by 13.12 percent.

On the other hand, VC funds were primarily raised by government agencies and investment companies by 41.77 percent, followed by sovereign wealth funds by 33.35 percent.

However, initial investments in 2020 experienced a significant downfall of 41 percent to RM 333.94 million. The event was likely because most PE and VC firms prefer to focus on the survival of their portfolio companies during the crisis rather than to invest in a newly found risk.

The majority of VC investments in 2020 were in the state of early-stage and growth with 50.5 percent and 38.89 percent, respectively.

While PE firms channel their funds primarily to the development of existing companies by 69.75 percent, followed by restructuring and early stages companies.

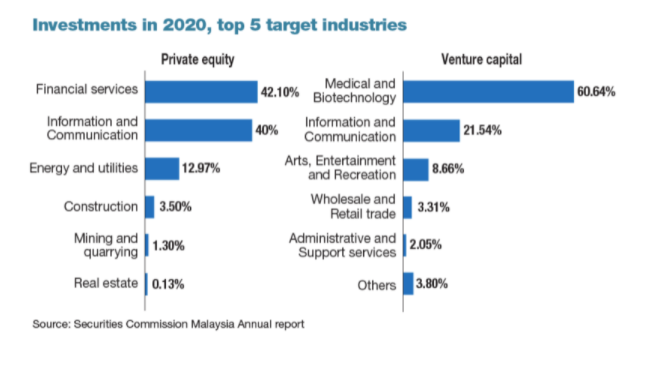

Medical and biotechnology became the highlight of investment destinations in the country, taking the highest share of VC investment in 2020 by 60.64 percent. Other high-traffic investment destinations involve information and communication sectors.

As for PE firms, investment funds were funneled mainly to financial services, followed by the communication and energy sectors modestly.

SC has stated its determination to engage various stakeholders to provide multiple opportunities for Malaysian VC and PE developments, further opening communications regarding the required enhancements needed to channel more investments to the country.

Furthermore, the commission is also planning to publish policies and announcements that would ease domestic investment conduct in the coming year.

The Latest Developments in Cryptocurrency Adoption in SEA

The cryptocurrency market in Southeast Asia (SEA) has seen exponential growth in recent years. The revenue of cryptocurrency in the region was around USD 1,384 million in 2023 and is expected to grow by USD 1 million in the next four years. Countries like Indonesia, Singapore, and the Philippines are at the forefront of this digital revolution. The region's young, tech-savvy population, coupled with increasing internet penetration, has created a fertile ground for the adoption of cryptocurrencies. Currently, the crypto market in SEA is valued at several billion dollars, with projections indicating continued growth.

An Overview of the Halal Cosmetics Market in Malaysia

The halal cosmetics market in Malaysia has been experiencing significant growth. It is driven by a combination of increasing consumer awareness, government support, and the rising demand for halal-certified products among both Muslim and non-Muslim consumers.

How Digital Marketing is Transforming the Automotive Lubricants Market in Southeast Asia

In recent years, digital marketing has emerged as a transformative force in the Southeast Asian (SEA) automotive lubricants market. The region's rapidly growing internet penetration and increasing smartphone usage have created fertile ground for innovative digital strategies. This evolution is reshaping how companies engage with customers and streamline their operations, offering numerous opportunities for growth and efficiency.

Exploring New Business Models for a Sustainable Future

Transitioning towards new sustainability business models can help companies drive positive change and contribute to a more sustainable future.